An Overview of the Battery Industry

The Battery Industry (Deep Dive Investigation)

As geopolitical power plays have begun to take center stage in recent years. We are seeing a renewed focus on energy supply and raw materials in both the private and public sectors.

Recent energy shortages have begun to prod at the underlying assumptions we have made at government levels about what it means to be conflict resistant. Underlying all of this has been a massive push towards energy independence from the Western world.

Much of this, a reaction to rising energy prices and a realization that in particular China has a decade-long head start and has been investing and planning for energy supply chain control long before the West realized its growing importance.

This lays the groundwork for this investigation into one of the most critical aspects of our energy future as a species. Battery Technology.

This investigation will be focused on the Battery Industry and touch on important aspects related to the industry including Battery Chemistry & Technology, Raw Materials & Supply Chain, Regional Trends, Battery Applications & Industry Sectors, Battery Recycling, Digital Twin Batteries, Self-Healing Batteries, Battery Company Landscape and more.

I’ve tried to structure it in a way that is beginner friendly but also has enough depth for experts in the space to use it as a reference source in coming years.

Ask: I am looking for someone to help maintain this battery industry database:

Battery Industry Company Database (click here)

If you derive value from this investigation, want to help maintain the battery company database or just want to get in touch, feel free to email me at javier [@] nomaddo.io or reach out to me via my Linkedin

What is a Battery?

A battery has the ability to convert chemical energy into electricity by facilitating a controlled interaction between specific chemicals. Within every battery, there are two essential components: a cathode, also known as the positive plate, and an anode, the negative plate. These electrodes are typically kept apart and are often surrounded by an electrolyte that allows ions to move between them.

Battery Types

The most common high performance battery chemistry is the lithium-ion chemistry. In these batteries, lithium ions move from the negative electrode to the positive electrode during discharge, and move backwards during charging.

In these batteries the cathode is a lithium transition metal oxide such as LCO, LMO, NCA, NMC, LFP, LMFP, etc.

An alternative to lithium-ion chemistries are lead-acid and sodium-ion batteries. This investigation will not touch much on lead-acid batteries, I may do a follow-up piece on them in the future.

Sodium-ion batteries are similar to lithium-ion batteries, with the only difference being that they use sodium ions (Na+) as charge carriers instead of lithium ions (Li+). The fundamental ideas and cell constructions are nearly the same, but sodium compounds are used instead of lithium.

While Sodiums-ion batteries are gaining traction in certain industries, lithium-ion technology still dominates the high performance battery market.

Some other next-gen battery chemistries are also currently under development, most promising of which are Solid State batteries and Li-Sulfur batteries. We will discuss these below in more detail but know that they are still considered nascent technologies.

Before we dive into the specific battery chemistries, it's also important to understand the anode material selection of these common battery types. Currently graphite based anodes are the industry standard. Graphite is a crystalline form of carbon and generally consists of stacked layers of graphene.

Newer material compositions are emerging aiming to have better anode properties, the most promising one of which are silicon based anodes. There are a number of complications with silicone based chemistries and thus far the industry has begun to mix silicon into graphite based anodes to improve the overall anode properties, but full silicon anode based batteries will require more development to achieve at scale.

Below is a break down of each of the common battery chemistries of interest for this investigation:

Battery Chemistries:

Lithium Iron Phosphate Batteries (LFP)

Lithium Iron Phosphate (LFP) batteries are gaining popularity in various sectors, such as transportation, large-scale stationary installations, and backup power systems. This is due to their affordability, enhanced safety features, minimal toxicity, extended lifespan, and other advantages. In the electric vehicle (EV) sector, LFP batteries hold a 31% market share, and an impressive 68% of this share comes from the production efforts of Tesla and the Chinese EV manufacturer BYD. What's crucial to their market dominance is their ability to tolerate full charge conditions and their resilience to extended periods at high voltage, which sets them apart from other lithium-ion systems.

LFP Key Opportunities:

Low/mid-range/entry-level EVs

e-Bus, e-Bicycle

Stationary storage

Cost sensitive applications

Nickel Manganese Cobalt Batteries (NMC)

People commonly use NMC in mobile devices, power tools, and electric vehicles. There's a specific interest in optimizing NMC for electric vehicle applications due to the material's high energy density and operating voltage. The secret of NMC lies in combining nickel and manganese as combining the metals enhances each other's strengths.

NMC Key Opportunities:

Long range/high-end EVs

Stationary storage, e-Bus, e-Bicycle, e-Motorcycle

Power tools / performance sensitive applications

Lithium Cobalt Oxide Batteries (LCO)

Its high specific energy makes Li-cobalt a popular choice for mobile phones, laptops and digital cameras. The drawback of Li-cobalt is a relatively short life span, low thermal stability and limited load capabilities.

LCO Key Opportunities:

VR headsets

Compact, portable drones

Small portable electronics

Lithium-Sulfur Batteries (Li-S)

The advantages of this technology stem from the batteries' low weight and the cost-effectiveness of sulfur compared to other battery raw materials, as well as the high theoretical energy density, which exceeds that of traditional lithium-ion batteries. Despite its promise, the technology is not yet commercially viable due to corrosion caused by a polysulfide shuttling effect that negatively affects battery lifespan and reduces the number of recharges the battery can undergo. Researchers are actively working on resolving this issue, but it will still take a few years to achieve a solution.

Li-S Key Opportunities:

Low/mid-range/entry-level EV’s

e-Bus

e-Trucking

Cost sensitive applications

Other Battery Chemistries:

Sodium-Ion Batteries (Na-ion)

Sodium-ion batteries (SIBs) are currently evolving as a viable alternative to lithium-ion batteries (LIBs) due to the abundant availability and cost-effectiveness of sodium.

Sodium, being three times heavier and having a lower standard electrochemical potential than lithium, presents challenges for SIBs to surpass LIBs in terms of energy density, specific capacity, or rate capability. Nevertheless, with the increasing scarcity and increasing cost of lithium, sodium is emerging as a practical replacement. Sodium could be incorporated into electric vehicle (EV) batteries in China as soon as the end of 2023.

Silicon Anode Based Batteries

Silicon-based materials have the potential to significantly enhance energy density. One silicon atom can accommodate four lithium atoms, in contrast to graphite, which requires six carbon atoms to host a single lithium atom. Silicon boasts a theoretical capacity of 3600 mAh/g, while graphite stands at 372 mAh/g.

Downsides include large volumetric expansion (300-400%) in Li alloying/dealloying. This can cause solid electrolyte interphase (SEI) development through excess silicon exposure and can disintegrate the whole anode. As a result, it has been challenging to make silicon dominant anodes and only a sprinkle (3-8%) is generally used.

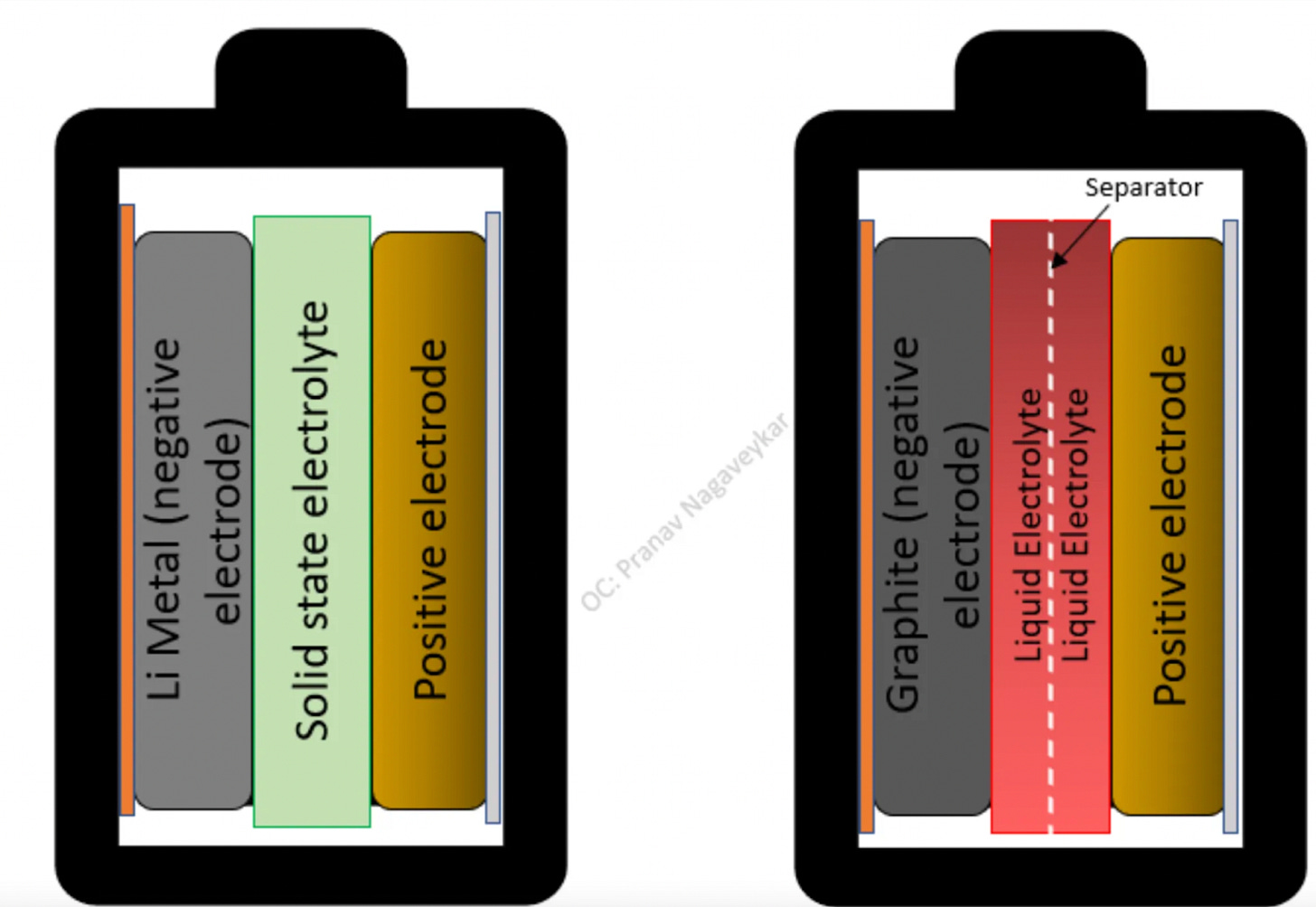

Solid State Batteries

Combines solid electrodes and a solid electrolyte in contrast to the liquid electrolyte based batteries seen above. Solid-state batteries can potentially solve many of the problems related to liquids (i.e. the mainstream type of) batteries, such as flammability, limited voltage, unstable solid-electrolyte interphase formation, poor cycling performance and strength.

Currently, solid-state batteries are much more expensive to produce than lithium-ion batteries. This is largely due to the fact that they require more complex manufacturing processes and more expensive materials. Another major challenge is durability. While solid-state batteries have the potential for longer lifespans than lithium-ion batteries, they also have a tendency to degrade more quickly. This is due to the fact that solid electrolytes are more prone to cracking and other forms of physical degradation. Researchers are currently working on ways to improve the durability of solid-state batteries, but this remains a significant hurdle.

Dive Deeper into Battery Chemistries Below:

This abundant material could unlock cheaper batteries for EVs

Battery Generation: (When) Will we see Solid State Batteries? Prof. Jennifer Rupp

A Tale of Two Chemistries: Battery Manufacturer’s Strategies for Winning both NCx and LFP Markets

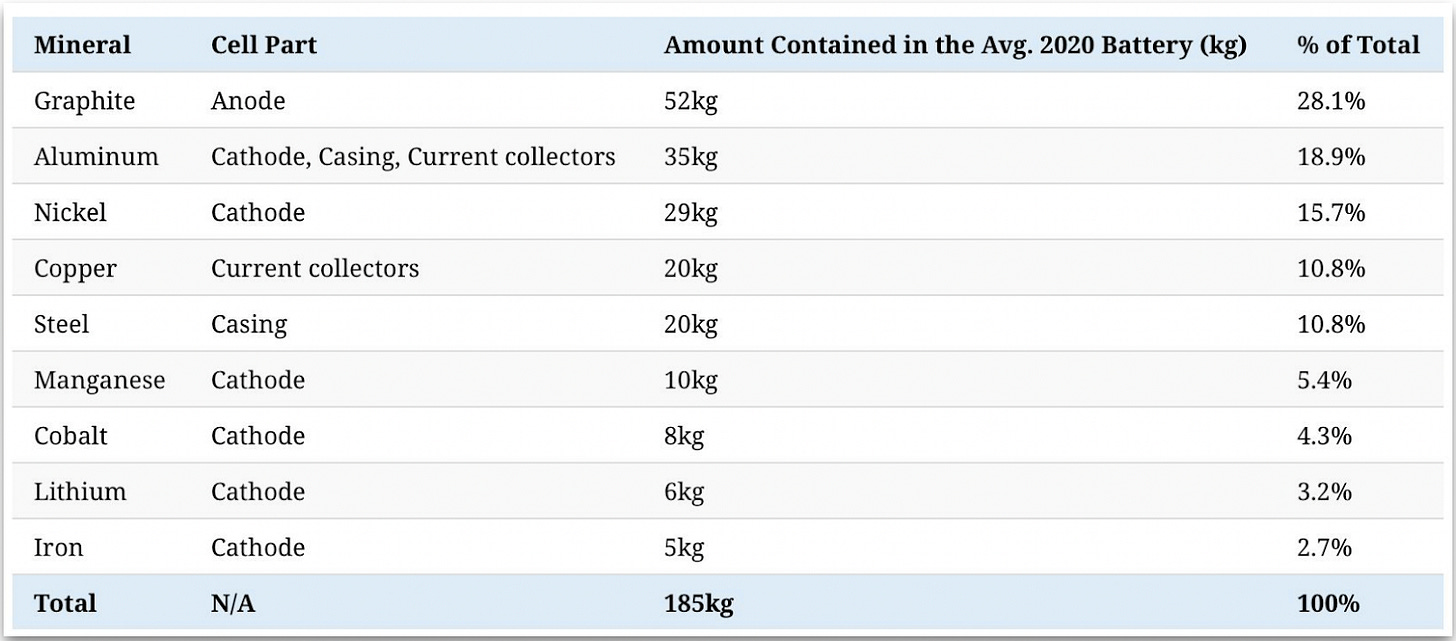

Battery Raw Materials & Supply Chain

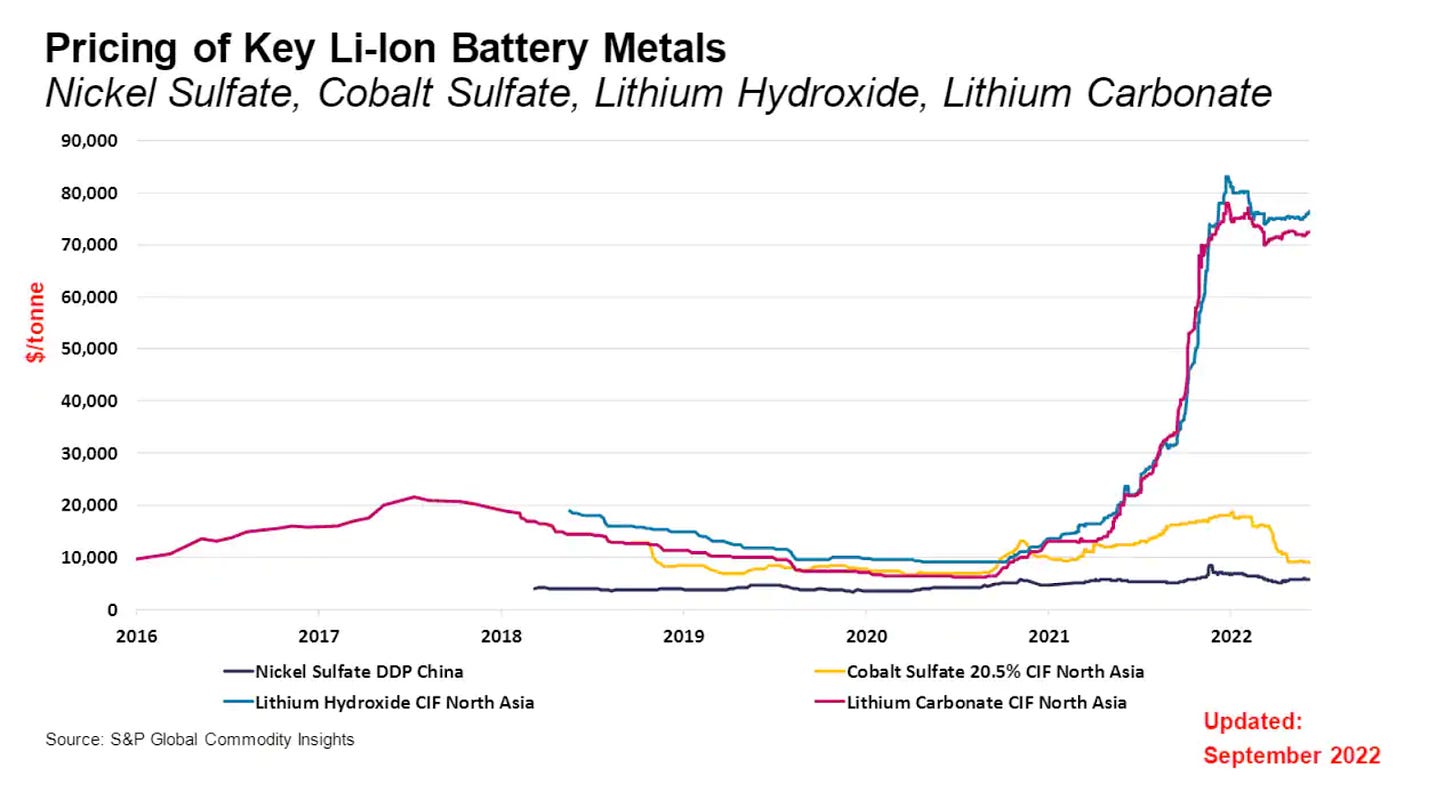

New technology usually does one of two things; It solves a problem or it makes something cheaper. Batteries have been no exception to this general technology trend. For many years the price of batteries decreased as better technology came to market. However, the last 2 years has seen this trend upended, owing largely to the increasing cost of raw materials.

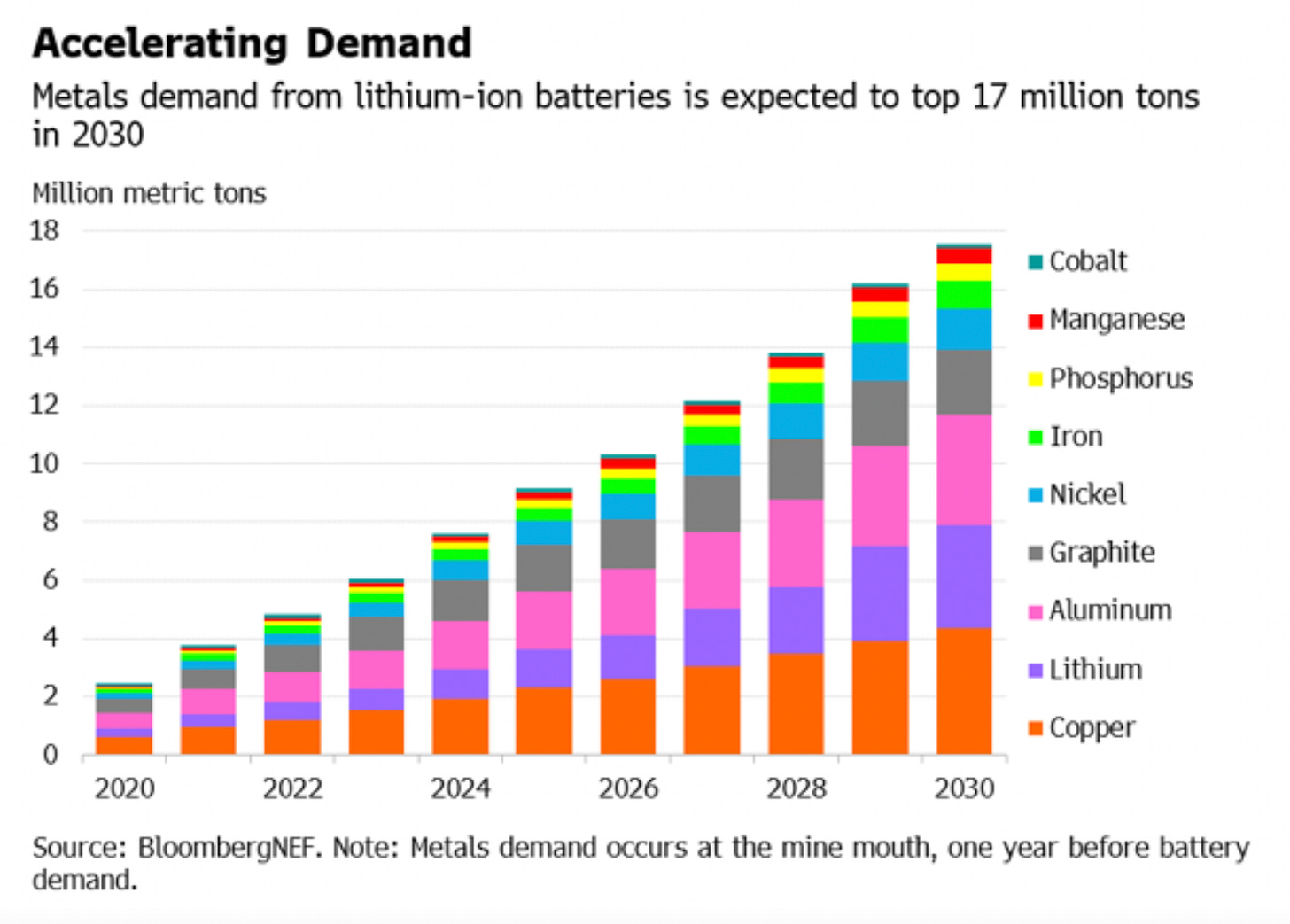

Surging demand for batteries in recent times has driven substantial increases in the demand for crucial metals used in battery production. From the beginning of 2021 to May 2022, lithium prices soared by over sevenfold, cobalt prices more than doubled, and nickel prices nearly doubled over the same period, reaching levels that hadn't been observed for nearly a decade.

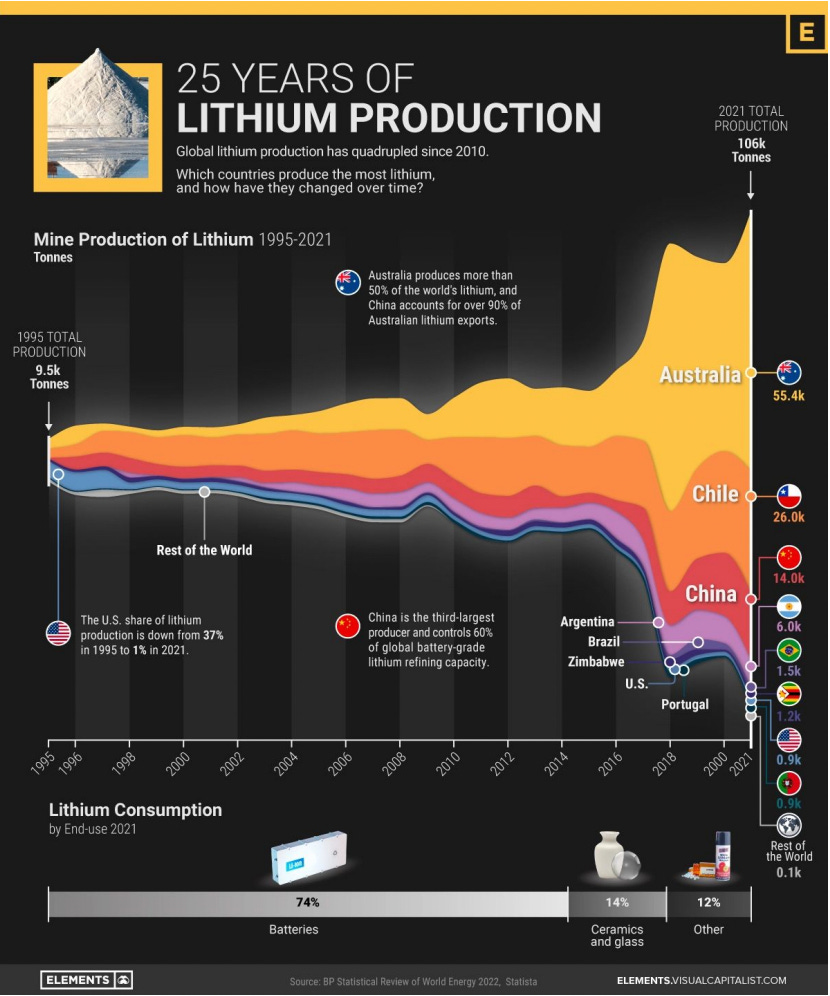

Lithium

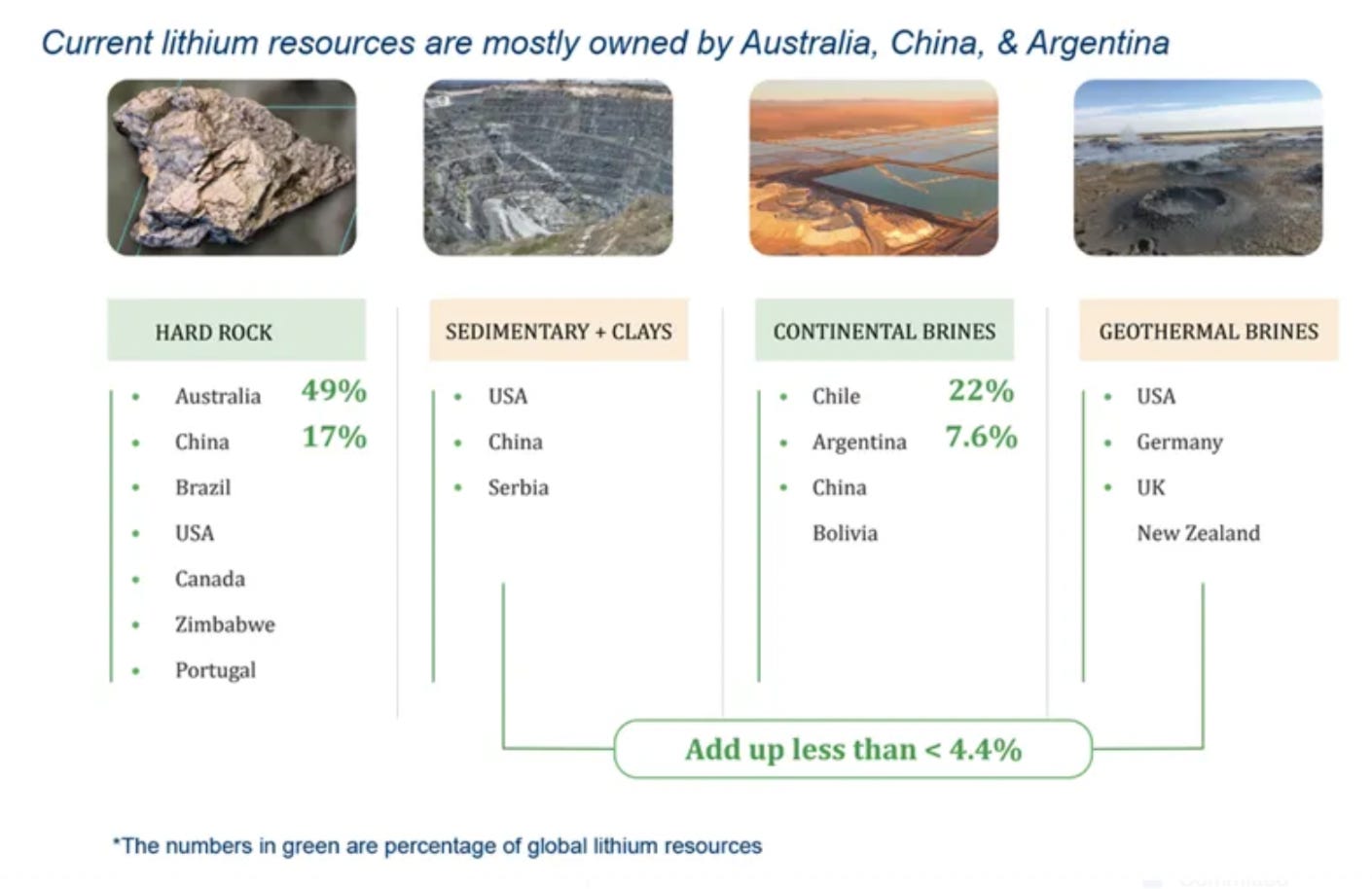

The present lithium market exhibits a significant degree of concentration, with approximately 90% of global lithium production originating from just three countries: Australia, Chile, and China. There are untapped lithium reserves in Latin America, primarily in Chile, Argentina, and Bolivia (collectively known as the Lithium Triangle), as well as in North America, specifically in Thacker Pass, Nevada, and the Salton Sea area in California. In theory, these reserves hold the potential to meet future demand, but their development is expected to be a time-consuming process.

Historical data shows us that it takes time to ramp up new production. Lithium mines that commenced operations between 2010 and 2019 took an average of 16.5 years to reach full development, requiring approximately 12 years for exploration and feasibility studies, followed by 4-5 years for construction.

Lithium Extraction:

Key to Lithium production is the development of new extraction technologies. The current Lithium extraction process is a long and arduous process. Lithium can be extracted from brines, rocks, or in clays. Lithium is consumed by battery makers as lithium hydroxide or carbonates depending on the type of cathodes.

Direct Lithium Extraction (DLE)

Of the new extraction technologies being developed, the one that the industry seems to be the most excited for is Direct Lithium Extraction (DLE).

DLE, or Direct Lithium Extraction, represents a technological advancement in the efficient extraction of lithium from either lithium brines or hard rock sources. It offers significant advantages over traditional methods, including increased efficiency, reduced chemical waste, faster processing speeds, and minimized land usage.

Nickel

Unlike other battery materials such as cobalt and lithium, nickel is unique in not being primarily driven by global battery demand. About 70% of the world's nickel production is consumed by the stainless steel sector, while batteries take up a modest 5%.

However, The battery sector's nickel demand is expected to accelerate substantially, with many predicting it to reach 35% of total demand by the end of the decade.

Cobalt

In 2022, the EV sector accounted for 40% of the total cobalt market. Because of its exceptional properties, cobalt is expected to remain a key raw material for the entire battery supply chain, despite discussions on substitution. Cobalt-containing chemistries represented 63% of cathode demand in 2022. They will remain a critical part of the EV sector and are expected to prevail in Europe and North America. However, some battery-makers have heavily invested in developing new chemistries that use less cobalt than ever before, reducing their dependency for the metal.

Reducing cost is not the only consideration driving EV companies away from heavily Cobalt relying chemistries. Human rights and environmental issues and public perception are also driving corporate behavior.

Graphite

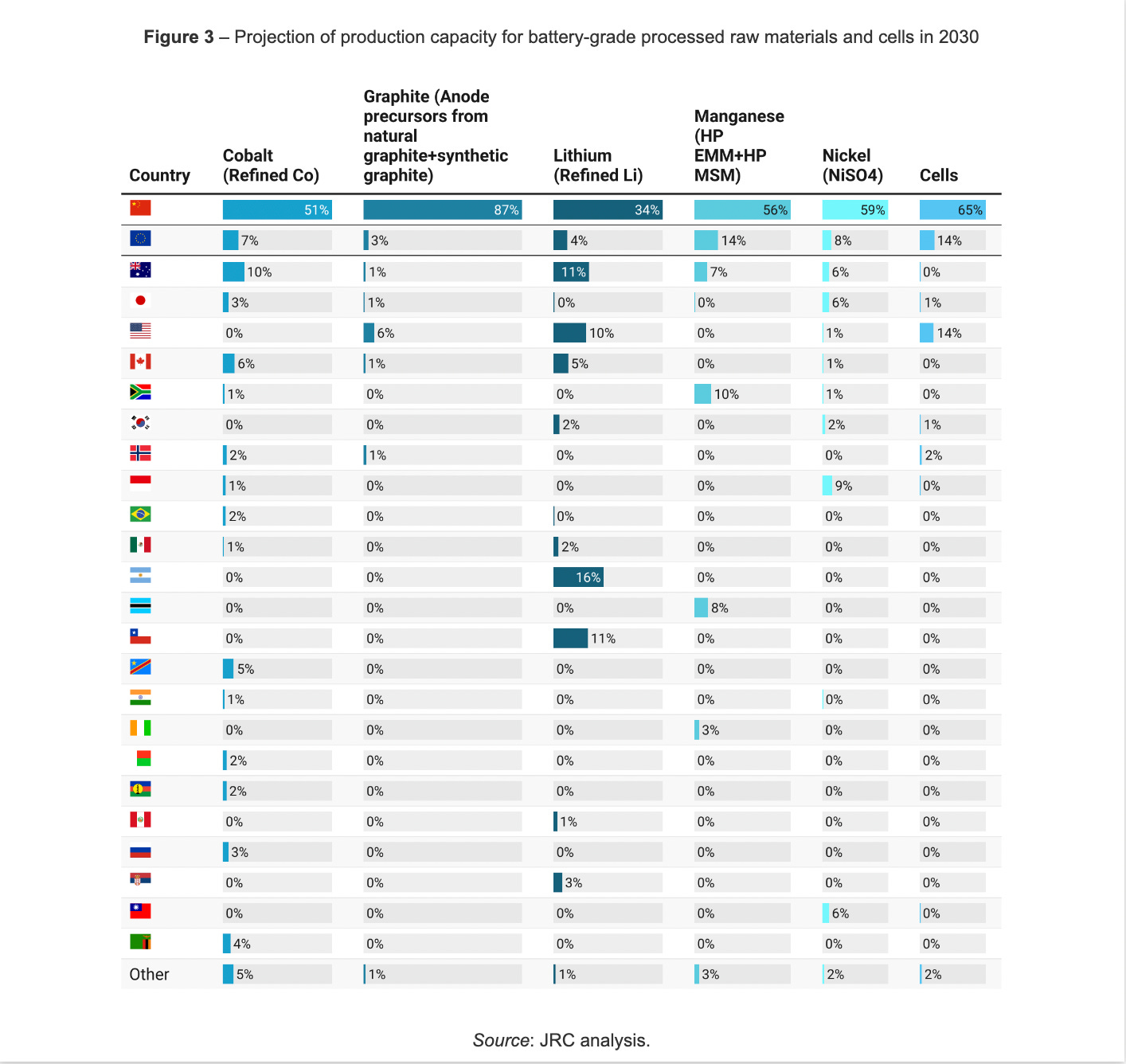

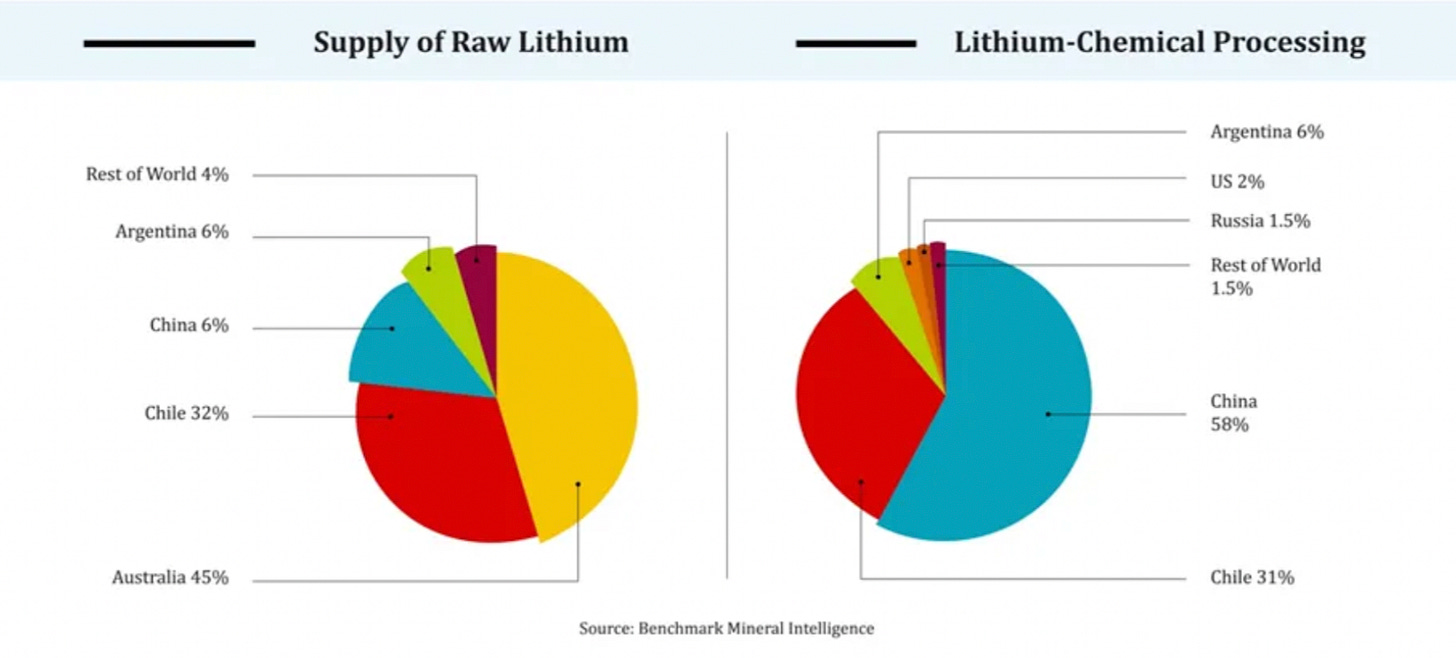

China dominates natural flake graphite production and holds monopoly on the conversion process for producing spherical graphite used for anode electrodes. The chemical purification process for spherical graphite requires intensive acid treatment, requiring hazardous materials like HF, which are highly regulated in jurisdictions like the US and EU.

Manganese

Demand for manganese from the battery sector is set to surge ninefold by 2030, the fastest growth rate of any of the industry’s key metals. South Africa, Gabon and Australia account for more than two-thirds of production of manganese

Supply Chain

Will there be sufficient metal supply and manufacturing capacity to meet booming demand?

There are massive profits to be made for expanding and building new mining operations worldwide. If there is one thing we have learnt throughout history is that when profits and healthy margins are available, private enterprise will step in to fill the gap. We are likely to see massive new mining projects launch in the coming decades. It is likely to take some time for all of that new capacity to enter the market, leading to short term shortages over the next decade.

Australia and Chile possess the largest lithium reserves, however Australia, Indonesia, and the Democratic Republic of Congo dominate mining. Furthermore, the majority of lithium processing occurs within China.

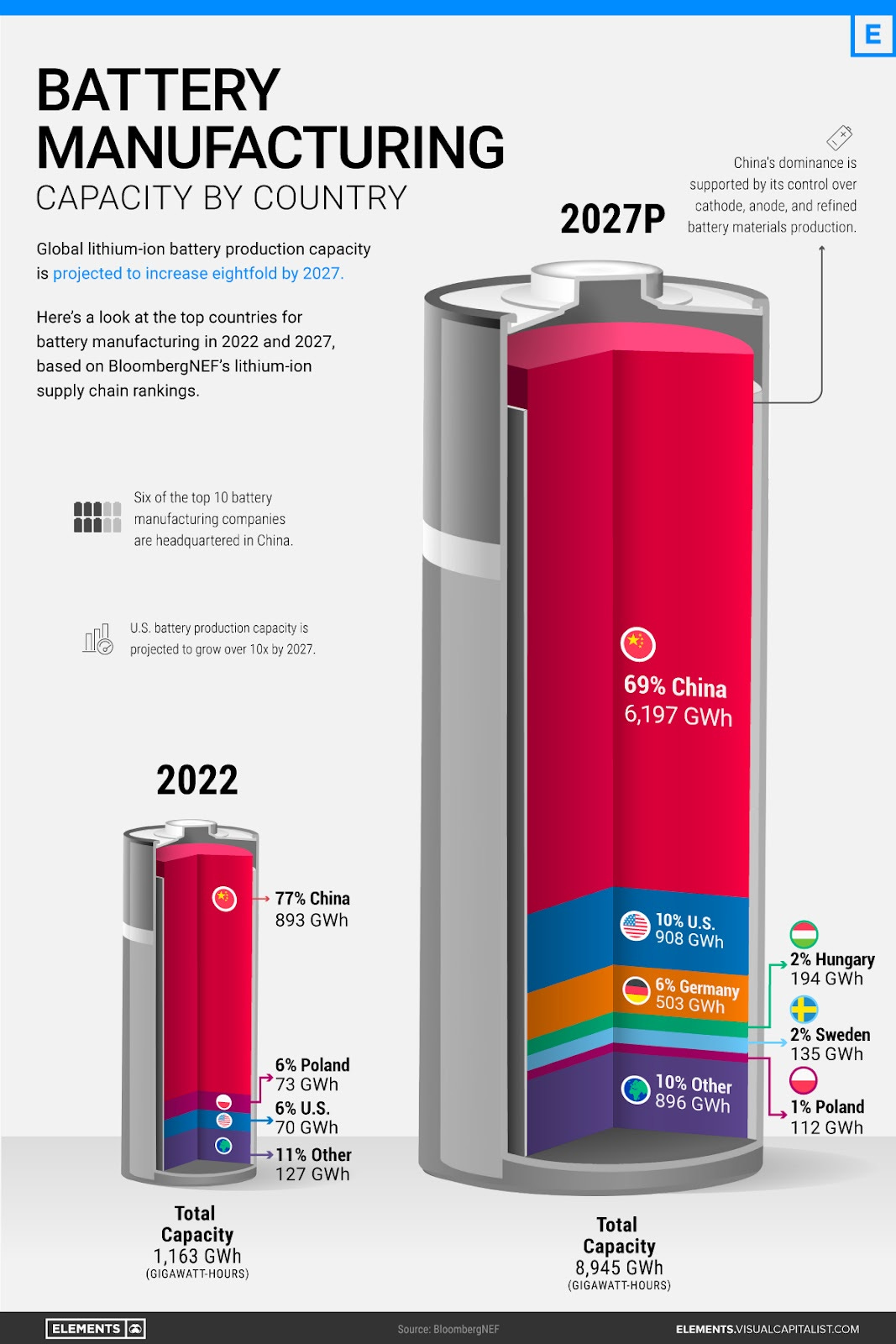

China is the largest processor of not only lithium but also nickel, cobalt and graphite, as well as the top producer of battery cell components and cells by a wide margin.

China holds a commanding position in the global battery industry, boasting nearly 900 gigawatt-hours of manufacturing capacity. China currently hosts 77% of all battery cell manufacturing capacity and 90% of anode and electrolyte production. China is home to six out of the world's ten largest battery manufacturers. This dominance is underpinned by China's extensive vertical integration across the entire electric vehicle (EV) supply chain, encompassing metal mining and EV production. Furthermore, China stands as the world's largest EV market, contributing to 52% of global EV sales in 2021.

In the meantime, the United States is anticipated to boost its capacity by over ten times in the coming five years. The EV tax credits included in the Inflation Reduction Act are expected to encourage battery manufacturing by providing incentives for EVs produced with domestically sourced materials. Notably, both Ford and General Motors, along with Asian companies such as Toyota, SK Innovation, and LG Energy Solution, have all revealed plans for investments in U.S. battery manufacturing in recent months.

To achieve self-sustaining domestic battery supply chains by 2030, the United States will need to allocate approximately $87 billion, while Europe will require around $102 billion in investments.

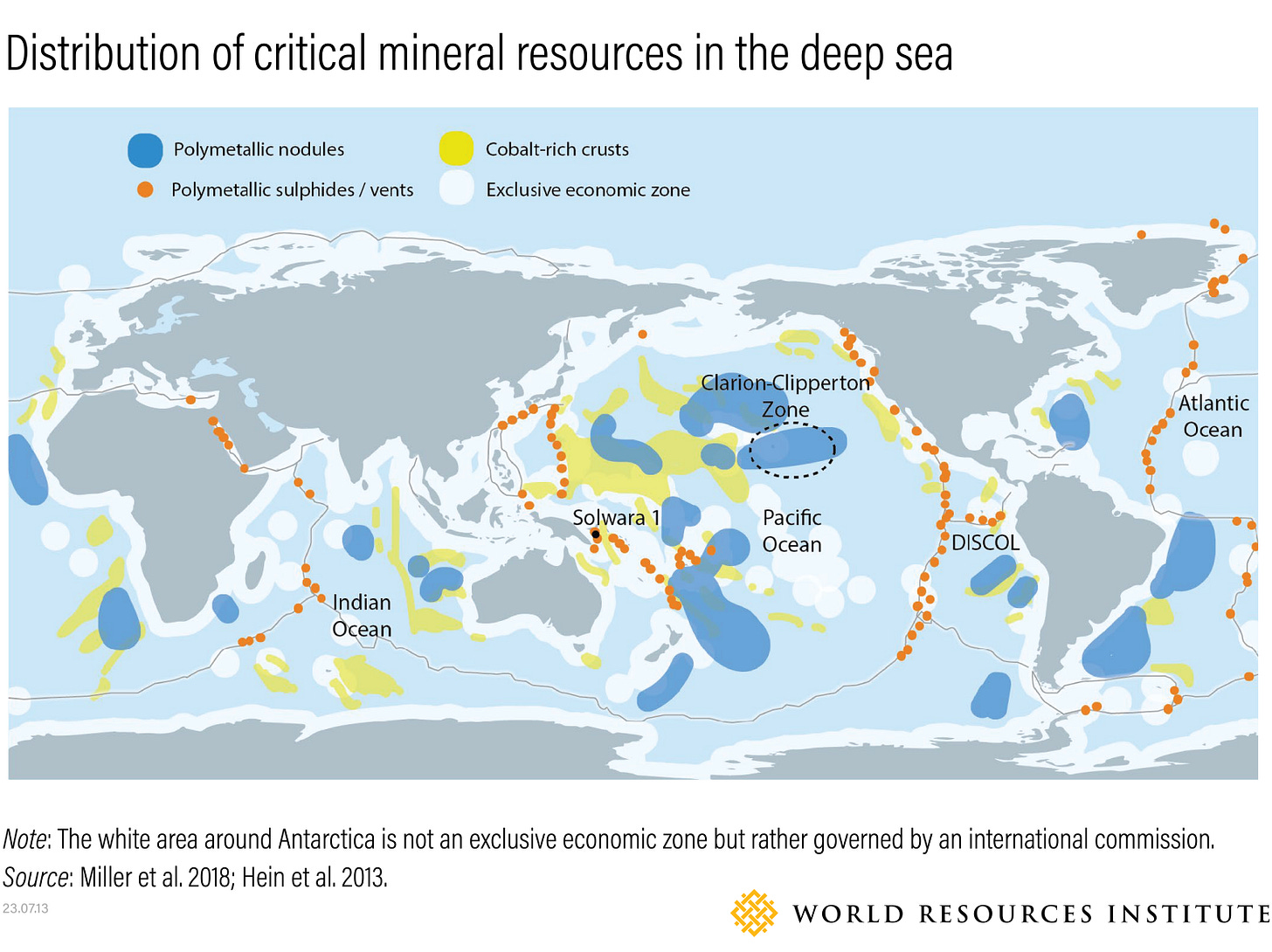

Deep Sea Mining

Deep Sea mining alternatives are beginning to be explored. There is lots of potential but also huge regulatory and environmental risk that has yet to play out.

Beneath the oceans, valuable minerals exist in several forms, including slowly forming polymetallic nodules, these are extensive polymetallic sulfides (comprising sulfur compounds and various metals that develop around hydrothermal vents), and metal-rich crusts found on underwater mountains known as seamounts. Although commercial interest in these mineral resources has persisted for many years, recent technological advancements have enabled the extraction of minerals from these areas through the deployment of submersible vehicles to collect deposits from the seabed.

Mining of the Deep Sea is still under study but metals are abundant on the seafloor. Reserves are estimated to be worth anywhere from $8 trillion to more than $16 trillion.

The Metals Company is leading the front on Deep Sea Mining exploration. It has become increasingly controversial as numerous scientists have raised apprehensions regarding the inherent dangers and the insufficiency of data concerning the potential outcomes of deep-sea mining. Nevertheless, the company is moving forward and expects to start mining operations in late 2025.

Dive Deeper into Battery Raw Materials & Battery Supply Chain Below:

Lithium Extraction Startup Landscape, role of direct lithium extraction (DLE) in energy transition.

A review of technologies for direct lithium extraction from low Li+ concentration aqueous solutions

A Look At Direct Lithium Extraction ("DLE") And Some Of The DLE Lithium Companies

Does the world have enough lithium to move to electric vehicles?

Exploring the Potential for Explosive Upside in the Lithium Market

Race to Net Zero: The Pressures of the Battery Boom in Five Charts

Challenges and Opportunities in Mining Materials for Energy Storage Lithium-ion Batteries

Report on strategic importance of raw materials mining in Europe

Regional Trends Breakdown

China

The Chinese battery market is expected to register a CAGR of greater than 7.5% during the forecast period of 2022 – 2027.

China is the largest market for electric vehicles (EV), and it is expected to remain the world’s largest electric car market.

Earlier, foreign automakers faced a 25% import tariff, or they were required to build a factory in China with a cap of 50% ownership. In January 2022, the 50% ownership rule was relaxed for passenger cars. Rules restricting a foreign company from establishing more than two joint ventures producing similar vehicles in the country were also removed.

Furthermore, the government of China is expected to cut subsidies on electric vehicles by 30% in 2022 and completely eliminate it by the end of the year. The planned subsidy cut is aimed at reducing the reliance of manufacturers on government funds for the development of new technologies and vehicles.

North America

The North America Battery market is expected to reach USD 32 billion by the end of 2023 and is projected to register a CAGR of over 10.5% during the forecast period of 2023 - 2028.

The adoption of electric vehicles is increasing rapidly in North America. The United States is already among the countries leading in global EV sales and other economies like Canada, which has already begun transforming its public transportation infrastructure for EVs are quickly catching up.

In an effort to achieve self sustaining energy independence, the US passed the Inflation Reduction Act (USA) in 2022:

A large part of this Inflation Reduction Act was focused on battery production and technology development.

Legislators estimated that to catch up with China, the United States will need to invest $175 billion for battery production in the next three years. At the same time, it will need to increase its recycling capacity and improve circularity in the battery supply chain. The domestic mining industry will need significant incentives to get there. Fortunately, the IRA’s production tax credit will speed this process along.

So far the IRA has awarded more than $86 billion in project investments. When combined, investments focused on EV or battery manufacturing represented more than 60% of the publicly announced projects linked to the IRA.

When it comes to who in the world is making these IRA linked investments, foreign companies led or were involved with nearly 100 projects, while U.S.-based companies led or were involved with 118 projects.

All of this results in more domestic US demand for raw materials, which impacts investment into mining and other related projects as well.

South America

The South America consumer battery market is expected to grow at a CAGR of approximately 5.81% during the forecast period of 2020 – 2025.

Lithium batteries dominated the market in 2018 and are expected to be the dominant segment during the forecast period. It has been estimated that South America’s Lithium Triangle hosts about 54% of the world’s lithium resources. As of 2019, Bolivia, Argentina, and Chile have around 21, 17, and 9 million tonnes of lithium reserve respectively. Thus, the huge Lithium reserves present in these countries is likely to act as an opportunity to increase domestic production in the near future.

Countries like Chile are expected to be future hoptspots for the lihtium-ion reserves. In 2023 Chile's President Gabriel Boric said he would nationalize the country's lithium industry, to boost its economy and protect its environment. The shock move from the world's second largest producer of the metal lays out a plan that would in time transfer control of Chile's vast lithium operations from industry giants SQM (SQMA.SN) and Albemarle (ALB.N) to a separate state-owned company.

Argentina is the world’s fourth largest producer of lithium and has been attracting lots of recent investment. Argentina’s first plant for lithium batteries will begin operations in late 2023.

Europe

Europe’s battery market is estimated to be at USD 23.34 billion by the end of 2023 and is projected to reach USD 43.84 billion in the next five years, registering a CAGR of 13.44%.

New regulation was passed in 2023 with an emphasis on new rules to extend producer responsibility and require due diligence of supply chains to assess social and environmental risks:

All EV batteries, LMT batteries and rechargeable industrial batteries with a capacity of more than two kWh must have a "clearly legible and indelible" carbon footprint declaration and label

Digital battery passport: EV batteries, LMT batteries and rechargeable industrial batteries more than two kWh will need a "digital battery passport"

Substantial regulation and industry targets for Battery Recycling and End of Life Management

How this regulation will affect the industry overall is yet to be determined.

Germany has been attracting investments from other countries worldwide to develop lithium-ion battery manufacturing facilities. For instance, in March 2023, Mercedes-Benz announced plans to set up a green battery recycling factory in Germany. The plant will have an annual capacity of 2500 tonnes and will contribute to the production of more than 50,000 battery modules for new electric vehicles of the company.

Asia

The Asia-Pacific Battery Market is expected to register a CAGR of more than 16.5% during the forecast period.

India is likely to experience significant growth in the Asia-Pacific battery market based on policy-level support from the government encouraging the manufacturing sector.

More specifically, the Southeast Asia Battery Market size is expected to grow from USD 2.67 billion in 2023 to USD 3.70 billion by 2028, at a CAGR of 6.77% during the forecast period (2023-2028).

Despite the growing demand for batteries in the automotive, data center, and telecommunication sectors, the battery energy storage segment is expected to witness stagnant growth, as most countries depend on other energy storage alternatives. This, in turn, is likely to restrain the growth of the battery market in the energy storage segment.

Several regional governments developed plans to reduce emissions, which are expected to increase the region's share of electric vehicles (EV) on the road.

Indonesia is poised to emerge as the foremost manufacturing center for lithium-ion batteries and their components in Southeast Asia. This transformation is primarily attributed to its plentiful reserves of essential raw materials such as nickel and cobalt, alongside substantial investments from international corporations.

Oceania

Australia's Battery Market size is expected to grow from USD 1,195.80 million in 2023 to USD 1,790.63 million by 2028, registering a CAGR of 8.41% during the forecast period (2023-2028).

Australia is inherently endowed with vast mineral riches, boasting extensive reservoirs of crucial metals like lithium, nickel, and cobalt, essential for the production and crafting of contemporary batteries. With a historically robust mining sector, Australia is well-positioned to play a pivotal role in the extraction, refinement, and utilization of these abundant reserves of rare earth metals. This is anticipated to fuel growth in the Australian battery market in the foreseeable future.Africa

Africa / Middle East

The Middle-East and Africa battery market is expected to grow at a CAGR of more than 4.93% during the forecast period of 2020 – 2025.

Even though electricity access in Africa has improved markedly in the past 20 years, expanding from 25% to 47% of the population. The total number of people without access to electricity in the African region is expected to increase from 588 million in 2016 to about 602 million in 2030, this is despite large scale efforts to boost electrification through grid connectivity.

The Sub-Saharan region is expected to be one of the central hotspots for off-grid solar initiatives. With suitable batteries deployed in a solar home system (SHS), mini-grid, or mesh-grid driving battery demand.

It is estimated that stationary battery capacity in Africa could grow by 22% annually through 2030 due to demand from energy access applications, and mini-grids alone could represent 40% of the 2030 market.

Market forecasts by the World Economic Forum show that as more Africans gain access to energy over the coming years, the demand for batteries will grow to 83 GWh by 2030.

In December 2019, Metair completed the construction of first EV battery plant, i.e. the South African auto parts maker has reportedly invested USD 15.1 million since 2017 to set up the first lithium-ion battery site. PAM Africa has also recently launched its plans to develop advanced batteries such as Li-ion and Na-ion batteries in Nigeria. Meanwhile Megamillion has plans to be Africa’s first large-scale manufacturer of Li-ion cells and battery packs, in hopes of bringing down prices and thereby catalyzing mass adoption of energy storage systems.

The United Arab Emirates government is targeting to have 42,000 electric cars on the roads. For that, in September 2017, the Dubai Electricity and Water Authority (DEWA) and the Road Transport Authority (RTA) announced incentives for electric car drivers, ranging from free public parking and charging to toll/fee exemptions and discounts on electric car registrations.

Dive Deeper into Regional Trends Below:

China’s Electric Vehicle Supply Chain and Its Future Prospects

CHINA BATTERY MARKET SIZE & SHARE ANALYSIS - GROWTH TRENDS & FORECASTS (2023 - 2028)

NORTH AMERICA BATTERY MARKET SIZE & SHARE ANALYSIS - GROWTH TRENDS & FORECASTS (2023 - 2028)

Inflation Reduction Act: Mapping the manufacturing law’s impact 1 year later

Charts: Which states will benefit most from the Inflation Reduction Act?

SOUTHEAST ASIA BATTERY MARKET SIZE & SHARE ANALYSIS - GROWTH TRENDS & FORECASTS (2023 - 2028)

A massive untapped electric vehicle market no one is talking about

AUSTRALIA BATTERIES INDUSTRY SIZE & SHARE ANALYSIS - GROWTH TRENDS & FORECASTS (2023 - 2028)

Challenges Facing the Battery Industry in Africa & Solutions

Applications / Industry Sectors

Electric Vehicles

Cars, Trucks, Vans, etc

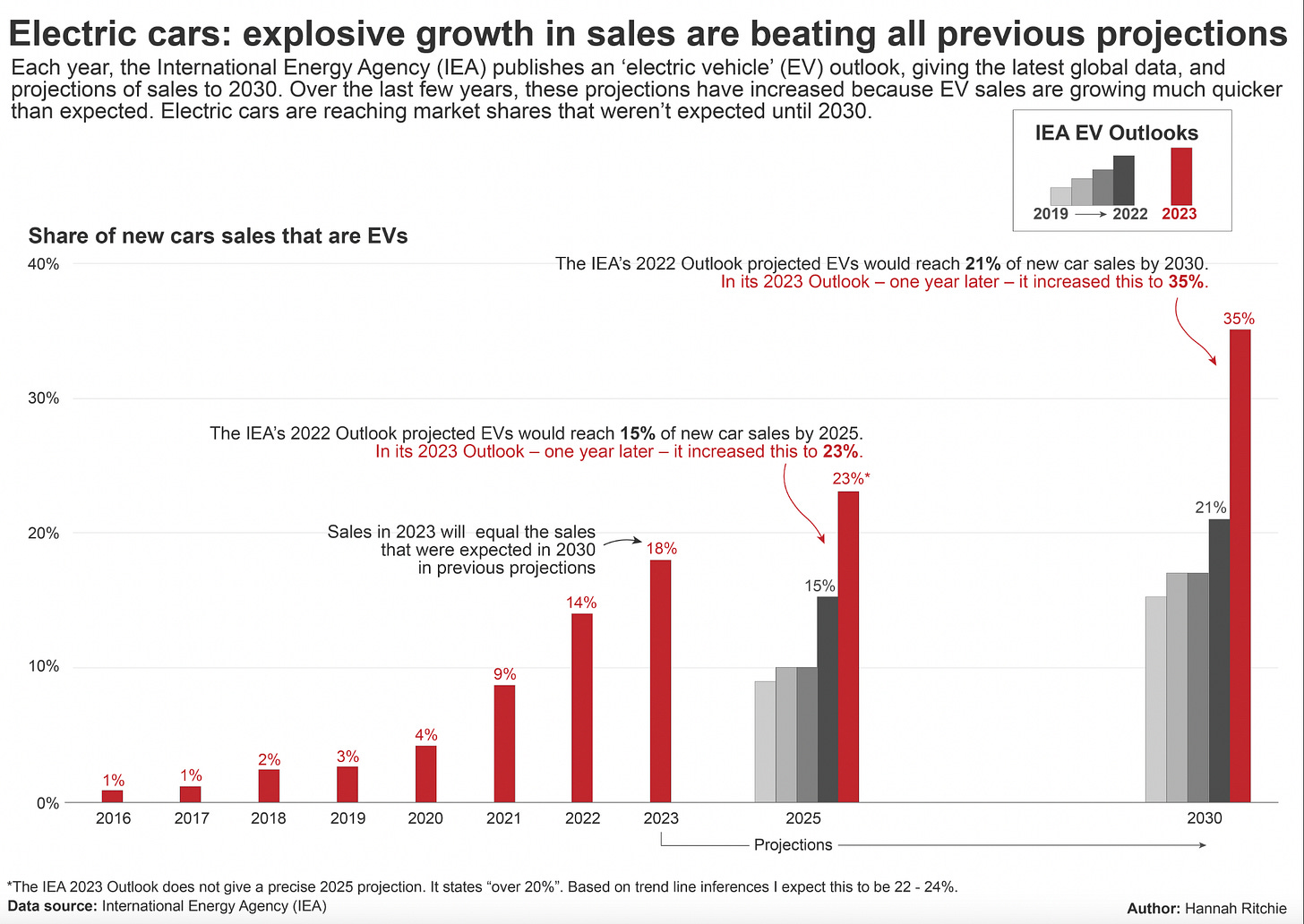

EV passenger vehicles are taking over the roads. Global EV sales as % of new car sales:

2020: 4%

2021: 9%

2022: 14%

2023: 18%

In the US, Long-established leaders in the automotive sector, namely Ford, General Motors (GM), and Volkswagen, are encountering obstacles as they strive to develop and expand their electric vehicle (EV) initiatives.

A recent example has been the cancellation by Ford for its plan to build a $1.6 billion plant in Mexico after Trump criticism. This led Ford to instead shift its focus towards building a domestic Michigan based factory. The Michigan project was also later cancelled amidst United Auto Workers union strikes and lagging EV sales.

During the initial half of 2023, Tesla's Model Y and Model 3 secured the top two positions in new electric vehicle (EV) car sales in the United States. They achieved sales figures of 200,000 and 160,000 units, respectively. In contrast, the Bolt managed to sell 35,000 units, while Ford's Mustang Mach E reached 13,600 units. These numbers fell significantly short of the volume required to efficiently utilize a standard assembly plant, which typically needs to operate at 80% capacity or higher to achieve profitability.

The big global battle in EV sales mirrors the geopolitical one. Tesla is the West’s EV champion and has been the global market leader for a number of years. A real challenger has finally emerged from China in recent years. BYD (Build Your Dreams) is a Chinese company based in Shenzhen founded in 1995 by chemist, billionaire, and entrepreneur Wang Chuanfu.

2023, Q3 sales data reveals that while Tesla delivered a commendable 435,059 pure electric cars, BYD was hot on its heels with sales of 431,603 pure electric passenger vehicles. This places BYD's EV sales at an impressive 99.21% of Tesla's for this quarter. It is likely that BYD will surpass Tesla in EV sales in Q4 or early 2024.

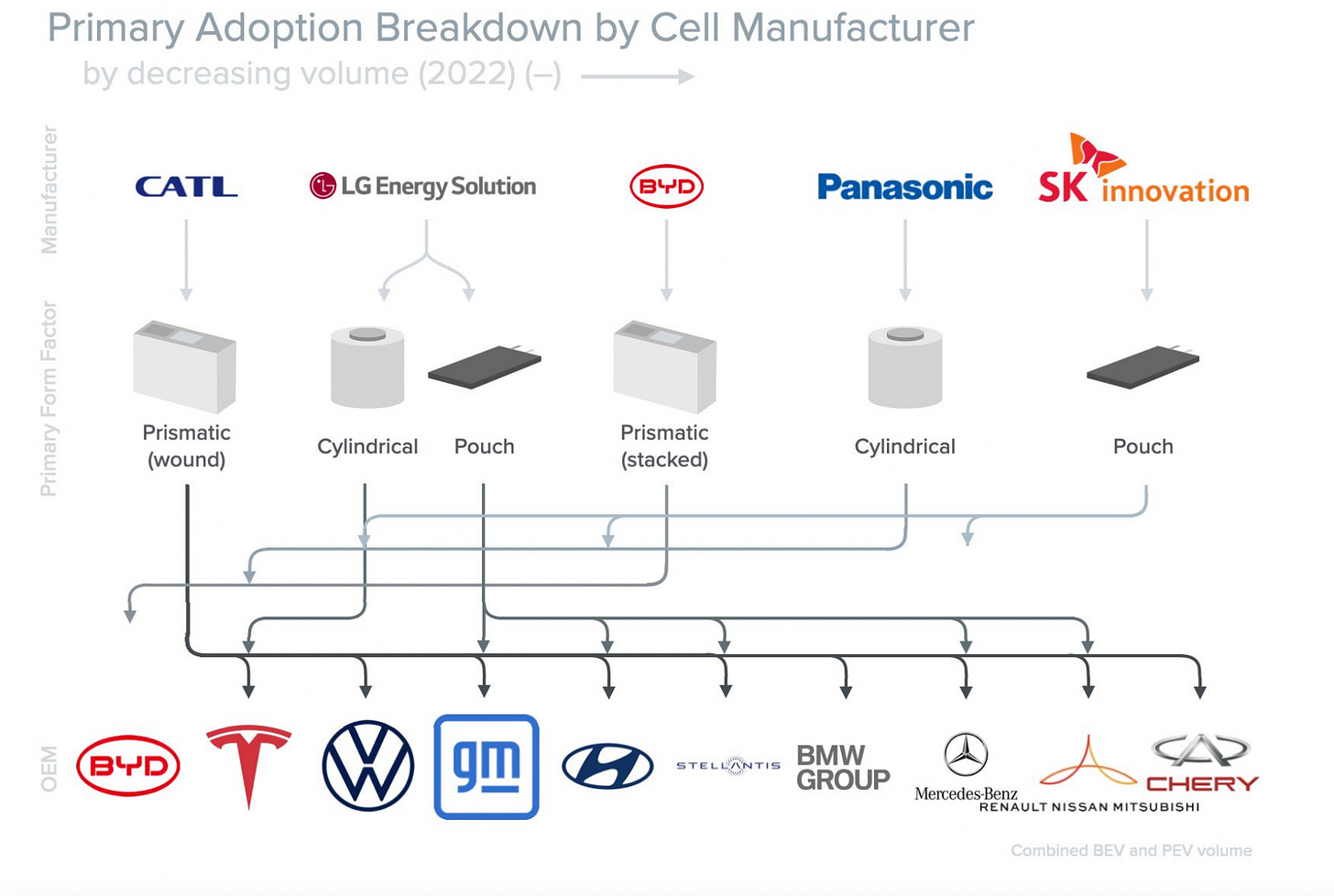

A major battle ground in this space and where many EV manufacturers are hoping to gain a competitive advantage is in Cell Form Factor design. This is an area that has been evolving to meet the specific needs of different EV Manufacturers and yielding increasing benefits.

There are significant trade-offs between cell form factors, these occur between Volumetric Energy Density (VED), Packing Efficiency and Safety (Thermal Runaway Propagation Resistance (TRP).

First generation EVs comprised mostly of cylindrical and pouch cells owing to their advantage in cost and manufacturability due to existing factory tooling. In addition to that, the pack designs themselves are also evolving, with a move towards monolithic designs, intended to eliminate dead weight, enable higher packing efficiency and lower costs.

Commercial Vehicles & Buses / Semis

Commercial vehicles (CVs), encompassing delivery vans, utility pickups, and police cars, play a crucial role in the United States' economy. Business and government fleets manage approximately 8 million vehicles falling within Class 1 to 5, not accounting for an additional 3 million used by individuals outside fleet operations, such as self-employed tradespeople. Recently, there has been a notable surge in the adoption of electrification within the CV sector, offering advantages to both customers and decarbonization initiatives.

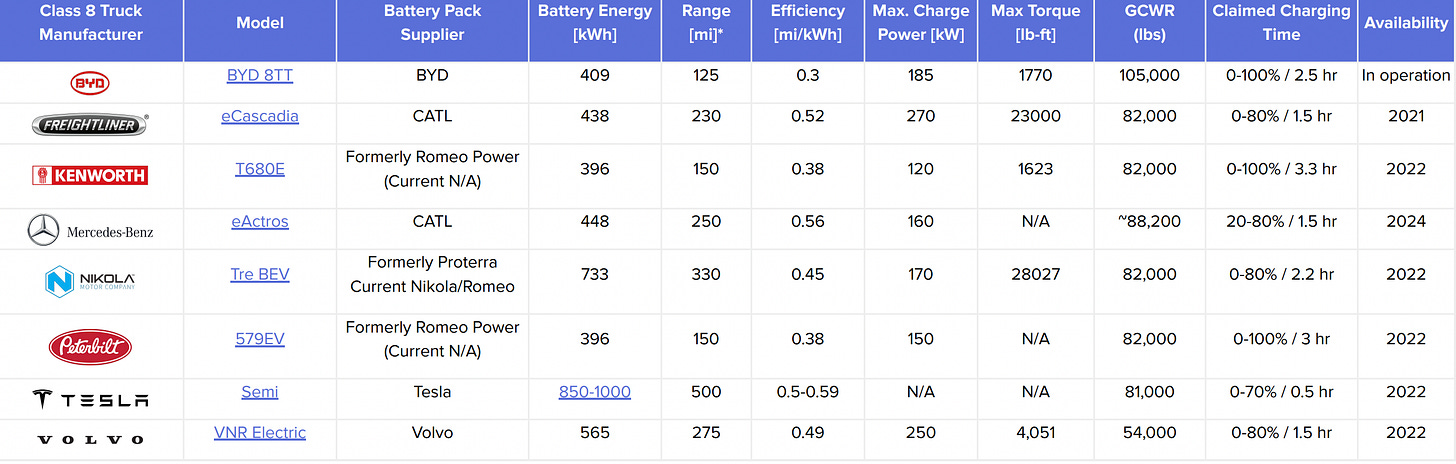

Manufacturers are currently addressing all classes of heavy-duty vehicles, including Class 5 to Class 8 vehicles. Numerous products are in the process of production and delivery.

Class 8, on the other hand, has garnered the most interest, due mainly to Tesla's initial deliveries of semi-trucks in the fourth quarter of 2022.

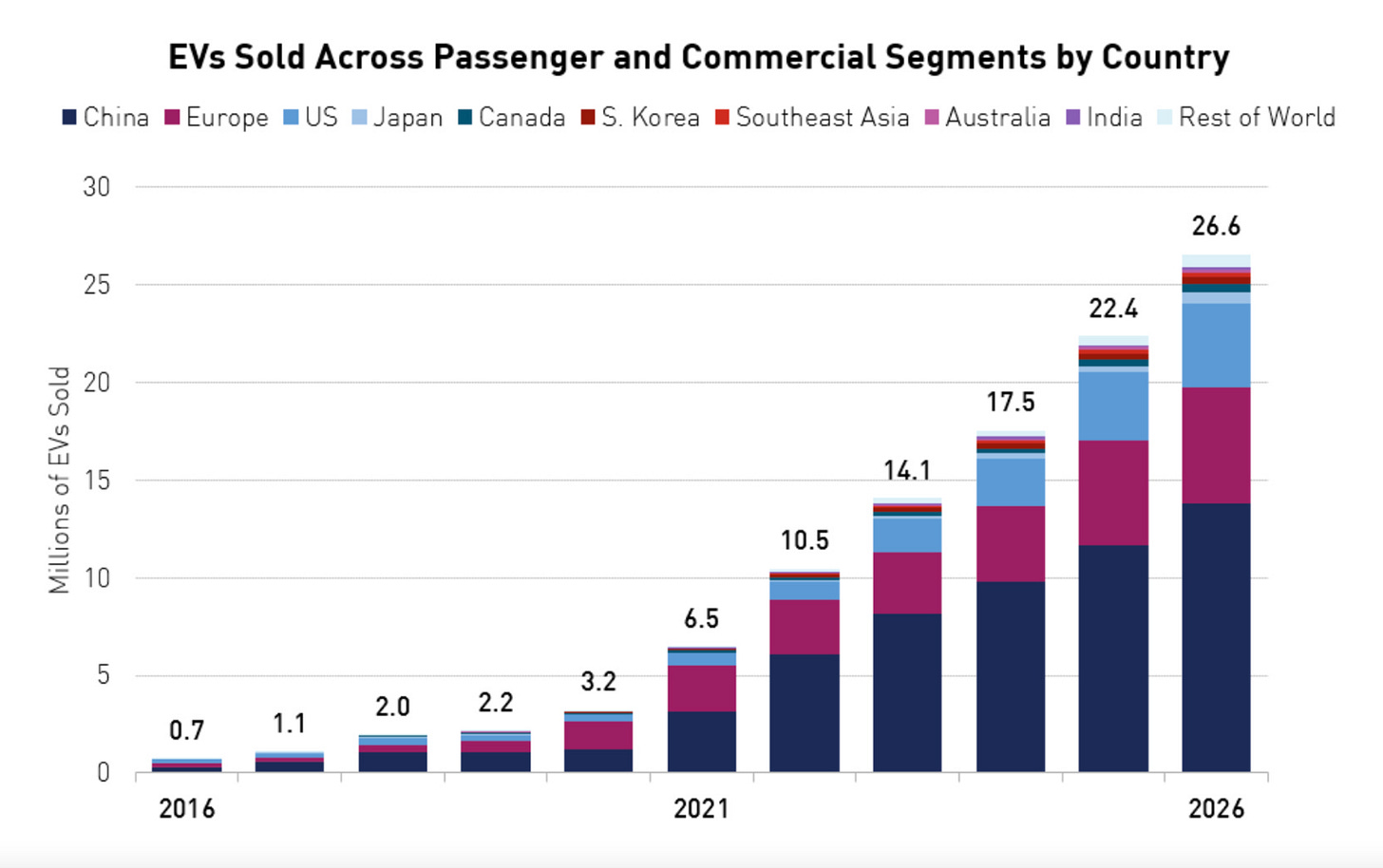

In the year 2022, approximately 66,000 electric buses and 60,000 medium-to heavy-duty trucks were sold on a global scale, constituting roughly 4.5% of all bus sales and 1.2% of truck sales worldwide. Notably, China maintained its dominant position in both the production and sales of electric vehicles, including trucks and buses. During 2022, China witnessed the sale of 54,000 new electric buses and an estimated 52,000 electric medium and heavy duty trucks, accounting for 18% and 4% of total sales in China, respectively. These figures represented a substantial portion of global sales, constituting about 80% of electric bus sales and 85% of electric medium and heavy duty truck sales worldwide. Additionally, it's worth mentioning that many of the buses and trucks sold in Latin America, North America, and Europe originate from Chinese brands.

Aviation

The number of startups exploring the Urban Air Mobility and Electrified Aviation markets is growing rapidly. With over 700 concept aircrafts catalogued in the VFS (Vertical Flight Society) directory

Efforts are taking off rapidly, spurred by advancements in tech, increased funding, and improved regulatory clarity. Many believe short range commercial flights will become feasible by the end this decade while serious technological challenges limit longer range commercial flight projects.

The primary challenge associated with electric aircraft has long been the fact that a high-quality lithium-ion battery cells have contained roughly one-fortieth of the energy content per unit weight compared to jet fuel. The meant that the aircraft's range would be reduced to just one-twentieth of its original capacity. Recent advancements in battery technology are making electric flight appear more achievable.

Despite energy density and battery weight holding electric aviation back from mass adoption, there are encouraging signs that electric flight could be arriving soon.

In 2022, United Airlines made an announcement regarding the purchase of 100 electric planes with a seating capacity of 19 from the Swedish startup Heart Aerospace. These zero-emission aircraft are scheduled to begin short-haul operations within the United States by 2026.

Meanwhile, in Europe, EasyJet's collaboration with the U.S. startup Wright Electric has resulted in the development of the Wright 1, a fully electric commercial passenger jet with 186 seats and an impressive 800-mile range. It is expected to commence service around the year 2030. Additionally, Wright Electric revealed plans in November for another electric aircraft, the Wright Spirit, which can accommodate 100 passengers and is slated for release in 2026.

Dive Deeper into Electric Vehicles (Cars, Trucks, Vans, Commercial Vehicles, Buses, Semis & Aviation):

Electric cars are the new solar: people will underestimate how quickly they will take off

A Tale of Two Chemistries: Battery Manufacturer’s Strategies for Winning both NCx and LFP Markets

Path Towards Mass EV Adoption — A Primer| Part 2: Cell Design

The Road to Electrification: Navigating the Global Auto Industry’s Transformation in 2023

The History of Electric Flight: Part I: Pioneers Colonel H. J. Taplin and Fred Militky

The History of Electric Flight: Part II: The steady evolution of electric RC gliders at Graupner.

Energy Storage

ESS (Electronic Stationary Storage) installation is projected to grow 15x & reach 1194 GWh by 2030. Grid-scale ESS installations dominate the storage capacity, with steady growth of behind-the-meter markets. The global residential battery market size is expected to grow to $28 Billion by 2030, led by regions with unreliable grid & high untapped solar market.

Lithium-Ion Batteries (Storage)

Li-ion-based (particularly LFP) ESS is likely to dominate new grid-scale energy storage construction for the next decade. But alternative energy storage technologies are being developed that provide unique trade-offs and benefits.

Packaging batteries into energy storage systems (which involves a lot of software for managing and monitoring power output) is a separate industry; some leading BESS integrators include Fluence, Wartsila, Powin, and Flexgen.

Non-lithium-ion alternative energy storage systems

Non-lithium-ion alternative energy storage systems have a lot in common — they tend to involve storing energy in mechanical or thermal form, using a fairly cheap/abundant material (like water or air), in huge reservoirs or caverns.

Most of these technologies are cheaper per kilowatt-hour than lithium-ion batteries today, which means they may be more suitable for the ultimate goal of complementing an all-solar energy grid.

This is a fascinating and underrated topic that will affect the overall battery industry greatly. The individual details of each storage technology is beyond the scope of this post that is intended to focus specifically on batteries, but I highly recommend reading Grid Scale Energy Storage Deployment by Technology Type: Part 1 & Grid Scale Energy Storage Deployment By Technology Type: Part 2 by Sarah Constantin at Rough Diamonds to dive deeper into the subject.

Alternative Non-lithium-ion Energy Storage Systems Include:

Pumped Hydro Storage: Electricity drives water up to an elevated reservoir; to release energy, water flows downhill and spins a turbine.

Flow batteries: Uses two liquids, separated by a membrane and circulated in order to enable ion exchange between them. By isolating the liquid electrolytes, flow batteries offer a long cycle life and can make use of their complete discharge range

Vanadium Redox Flow Batteries: Vanadium ions flow between a negative electrolyte tank and a positive electrolyte tank.

Compressed Air: Energy is used to compress air and store it in a tank in a big underground cavern; letting the air flow out releases energy to spin a turbine and generate electricity.

Green Hydrogen: Utilizes electricity to electrolyze water into hydrogen and oxygen; then you store hydrogen in caverns underground; then you burn it in a gas power plant to get the electricity back out.

Thermal Hydro: stores energy as the difference in temperature between two water reservoirs.

Molten Salt Thermal: Heat generated by solar power is stored in molten salt and turned into electricity by heating up steam to spin a turbine.

Liquid Air: Liquid air energy storage uses electricity to cool air until it liquifies, and then releases electricity by allowing the air to warm up to ambient temperature and spin a turbine.

Thermal Aluminum: Uses electricity to heat up an aluminum alloy until it melts. Then is uses a heat transfer fluid and engine to extract the stored energy.

Iron-Air Battery: Turns iron to rust to discharge, and charges by using electricity to turn rust back into iron.

Geomechanical Pumped Storage: Instead of pumping water up a hill, you pump it into a well. The energy is stored in the form of pressure, and released when the water is allowed to flow through a turbine to generate electricity.

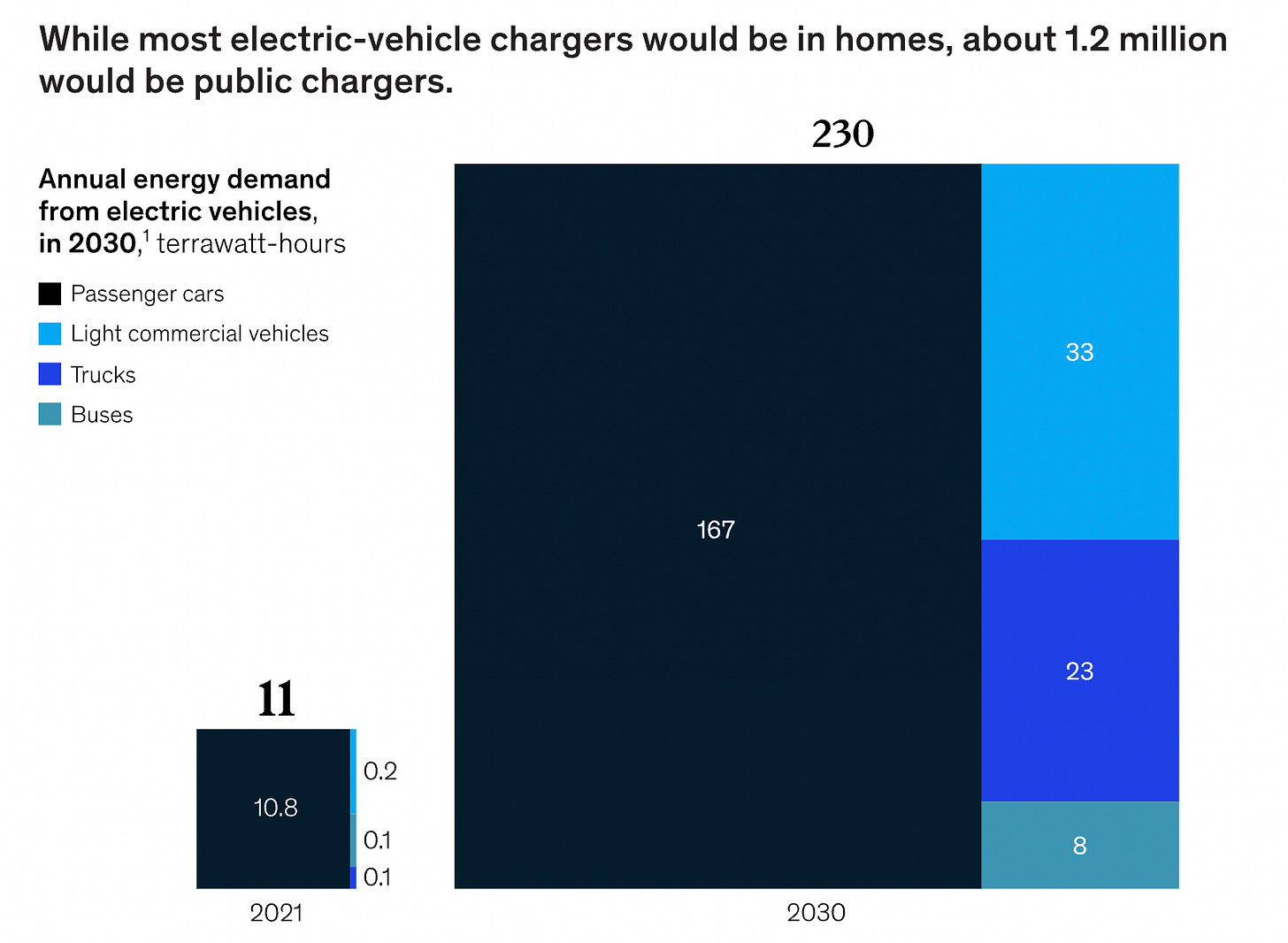

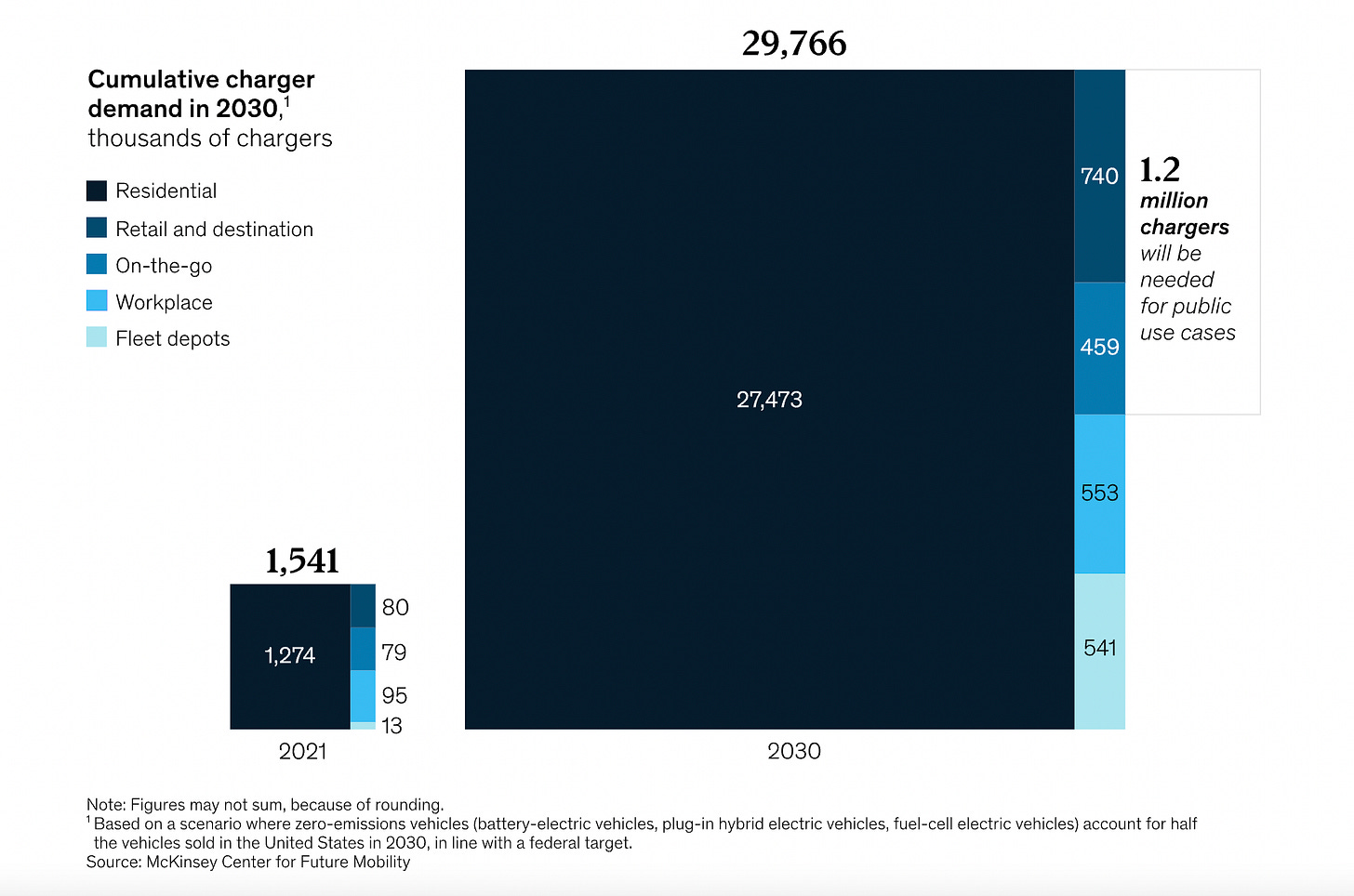

EV Charging Infrastructure

While the majority of charging demand is currently fulfilled through home charging, there is a growing need for publicly accessible charging stations to offer the same level of convenience and accessibility as traditional vehicle refueling, especially in densely populated urban areas where home charging options are limited. As of the conclusion of 2022, there were a total of 2.7 million public charging points worldwide, with more than 900,000 newly installed in 2022. This represents a substantial 55% increase over the stock in 2021, which is comparable to the growth rate seen before the pandemic, specifically the 50% growth between 2015 and 2019.

On a global scale, over 600,000 public slow charging stations were set up in 2022, with 360,000 of them located in China. This expansion increased the total number of slow chargers in China to surpass 1 million. As of the close of 2022, more than half of the world's public slow chargers could be found in China.

Publicly available fast charging stations, particularly those situated along highways, play a crucial role in facilitating extended electric vehicle journeys and can effectively alleviate concerns related to limited driving range, which have historically deterred some from adopting EVs. Similar to slow chargers, public fast charging stations serve as a vital resource for individuals lacking consistent access to private charging options, thus promoting the adoption of electric vehicles among a broader demographic. In 2022, the worldwide count of fast charging stations saw a substantial increase, with 330,000 additional units, and notably, nearly 90% of this growth occurred in China.

In 2022, the United States introduced 6,300 fast chargers, with approximately 75% of them being Tesla Superchargers. By the close of 2022, the cumulative count of fast chargers reached 28,000. Anticipated growth in deployment is on the horizon in the coming years, thanks to government approval of the National Electric Vehicle Infrastructure Formula Program (NEVI). All U.S. states, Washington DC, and Puerto Rico are active participants in this program, and they have already received a total of USD 885 million in funding for 2023 to facilitate the expansion of charging infrastructure along 122,000 kilometers of highways.

Battery swapping

Battery swapping is a new technology that allows electric vehicle (EV) owners to swap out their dead or dying batteries for fully charged ones in a matter of minutes. The EV battery swap process is simple: when an EV owner needs to recharge their vehicle, they drive to a designated battery swap station and park in a bay. A robotic arm then removes the depleted battery from the vehicle and replaced it with a fully charged one. The whole process takes about three minutes, and once its complete, the driver can continue on their journey with no interruption.

China is also the leader in battery swapping technology. Across all modes, the total number of battery swapping stations in China stood at almost 2,000 at the end of 2022, 50% higher than at the end of 2021. NIO, which produces battery swapping-enabled cars and the supporting swapping stations, runs more than 1,300 battery swapping stations in China, reporting that the network covers more than two-thirds of mainland China.

Private investment into EV charging infrastructure

Private investment into EV charging hardware & software startups is booming, and annual investment into EV charging infrastructure could reach $140–190 billion in 2030. VC/PE investment into EV charging hardware & software startups exceeded $3.25B in 2022. Cumulative VC/PE into EV charging startups now exceeds $8.25B.

Global capital expenditure on EV charging infrastructure exceeded $10B in 2021. Through year-end 2021, cumulative investment in the sector exceeded $50B.

By 2030, global annual capex on (public and private) EV charging infrastructure will need to reach $140–190 billion to support the forecast adoption of EVs, according to the International Energy Agency.

Bidirectional charging

Bidirectional charging also starting to become available in various new vehicle releases. Bi-directional charging enables electric vehicles to power equipment, homes and buildings. Even more interesting is a new technology that automakers have also recently launched called Vehicle to Grid (V2G) which allows EVs to sell energy back to the grid.

Dive Deeper into Energy Storage & Charging Infrastructure:

Grid Scale Energy Storage Deployment by Technology Type: Part 1

Grid Scale Energy Storage Deployment By Technology Type: Part 2

Building the electric-vehicle charging infrastructure America needs

Battery Swapping: The Game-Changing Technology For Electric Vehicles

California plans to make bidirectional charging mandatory on all EV's

Which countries have ‘enough’ public chargers for electric cars?

Battery Recycling

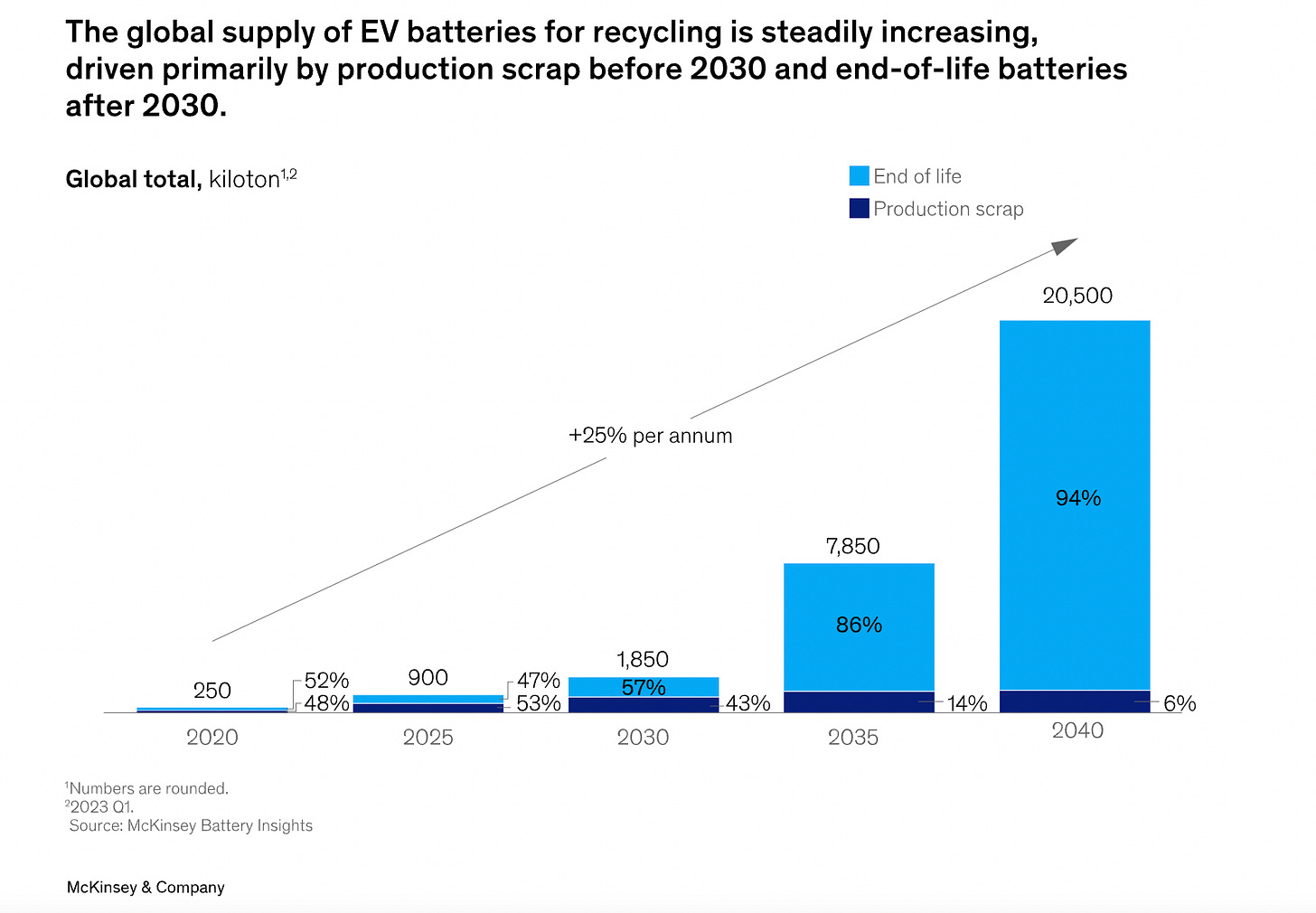

The primary source of recyclable battery materials still originates from consumer electronics cells, like those found in laptops and household devices, as well as from manufacturing scrap resulting from faulty batteries that fail quality control assessments.

More interesting for us, is the considerable growth in EV battery volumes that are reaching their end-of-life. It is anticipated that within the next decade over 100 million vehicle batteries will be retired.

A typical EV battery retains around 80% of its capacity when it no longer meets EV standards, making it suitable for other applications, such as stationary storage in buildings and the electric grid. Repurposing these batteries is increasingly seen as a preferable option over recycling due to the embedded value in these partially depleted yet functional batteries.

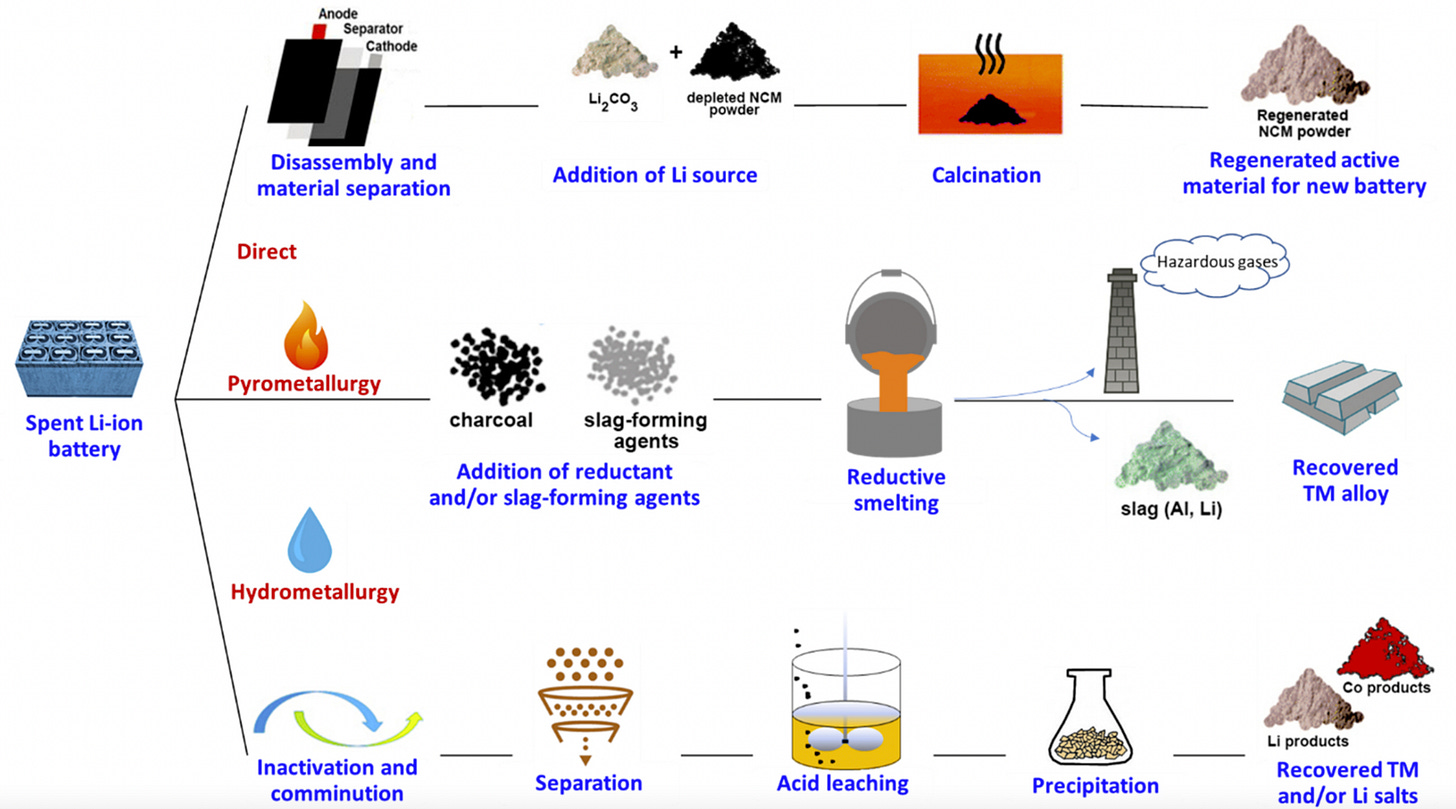

However, when repurposing is not feasible, battery recycling becomes crucial. The recycling process starts with collecting and sorting end-of-life batteries, and some recycling technologies, typically hydrometallurgy and direct recycling, require batteries to be discharged, dismantled, and shredded before the next step in the process.

There are three primary methods for recycling lithium-ion batteries:

Pyrometallurgy: Involves high-temperature processes to extract valuable materials

Hydrometallurgy: Which uses chemical methods for material recovery

Direct recycling: Which focuses on reusing intact battery components.

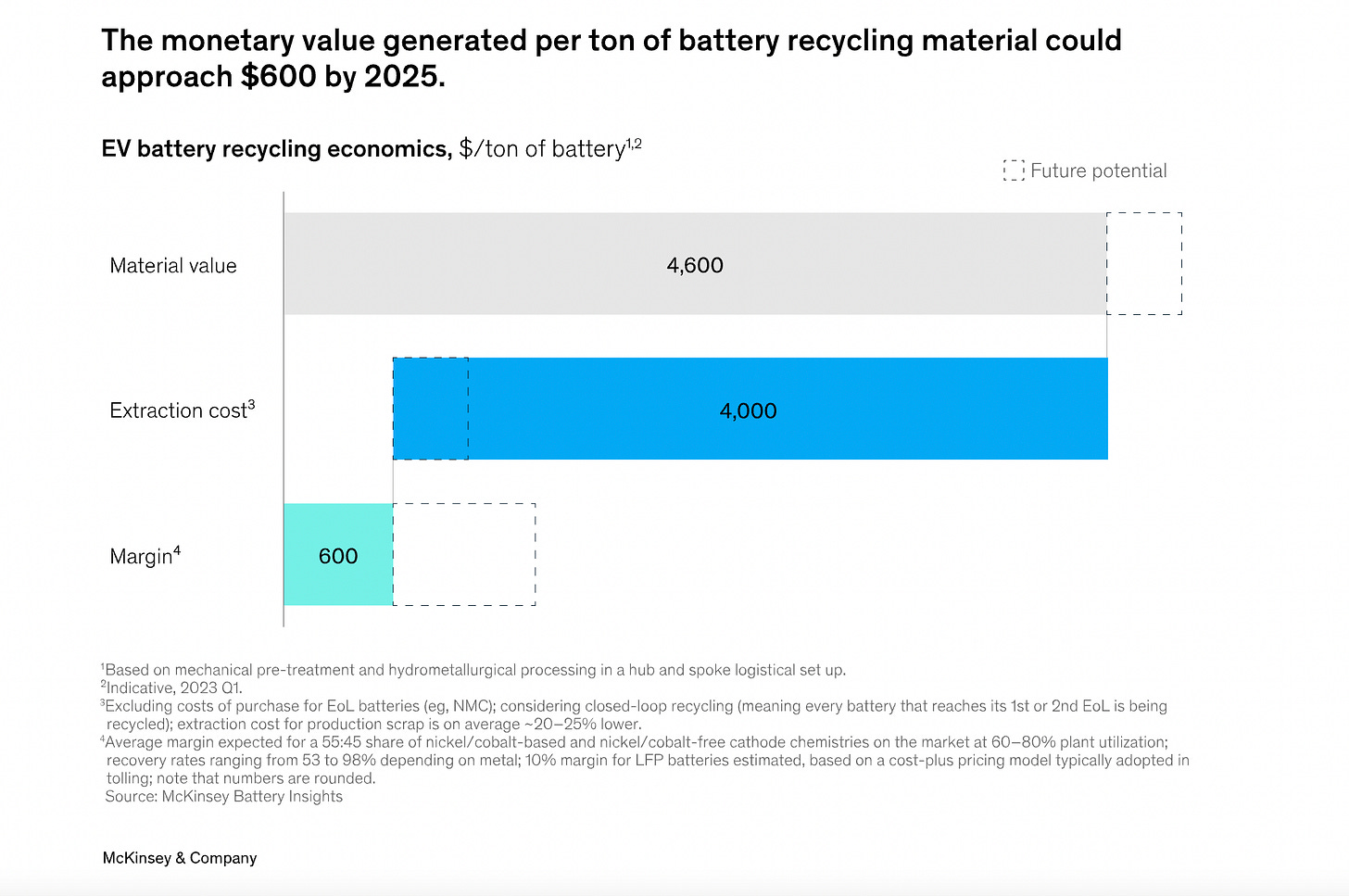

From collection to metal recovery, it's projected that annual global revenues will surpass $95 billion by 2040. This expected growth is primarily driven by factors such as increasing prices for recovered metals, the adoption of new battery cell chemistry, and the regionalization of supply chains. By as early as 2025, the value per ton of battery material is expected to approach $600

Dive Deeper into Battery Recycling Below:

Digital Twins

A digital twin is a virtual replica of a physical system employed for optimizing performance and predicting behavior. Various simulations and modeling applications represent instances of digital twins, which focus on specific aspects like material behavior, fluid dynamics, or thermal performance. Nevertheless, constructing a digital twin necessitates the intricate integration of comprehensive system data, encompassing real-time, historical, and both process and material data.

Dive Deeper into Digital Twins Below:

Self Healing Batteries

Li-ion battery cells are prone to different degradation processes:

Mechanical degradation: The mechanical loss of ionic or electronic contacts between active particles and additives.

Chemical and electrochemical degradation: encompasses degradation in the form of electrolyte decomposition and formation of passive films, lithium plating/dendrite formation, transition metal dissolution, and gas evaluation and degradation of inactive components.

This emerging technology has great promise but is still in its infancy. It is quickly becoming a popular area of battery research around the world.

Dive Deeper into Self-Healing Batteries Below:

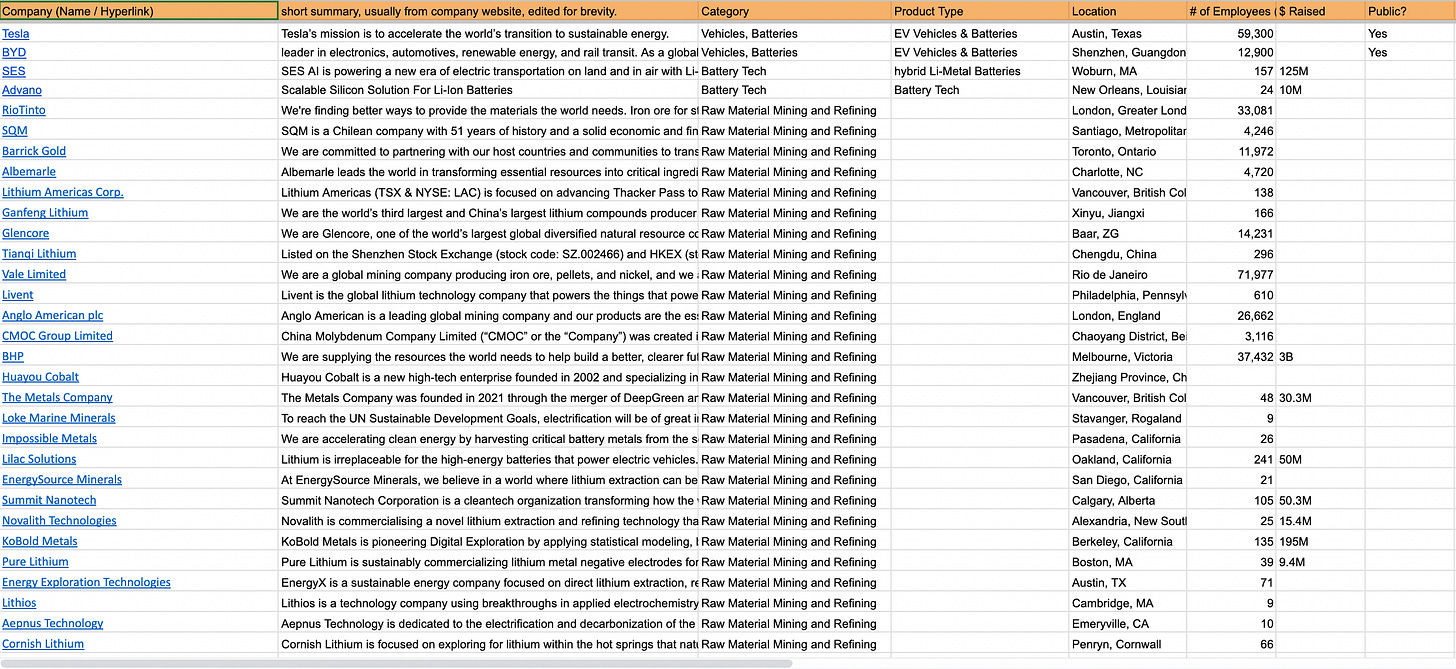

Battery Company Landscape

Spreadsheet (View Only): Battery Industry Company Database (click here)

I will be writing some more research pieces that go into more detail and analyze interesting startups across the battery tech landscape.

In the meantime, feel free to take a look at my ongoing database of battery tech companies. I am looking for someone to help maintain this database as there are many new entrants coming into the market and its challenging keeping track of everything.

If you are interested in helping me maintain this database, please send me an email to javier [@] nomaddo.io

Battery Industry Company Database (click here)

Conclusions

Battery tech is an often neglected area of geo-political tension. It’s easy to see on the news that oil, artificial intelligence and GPUs are issues of contention but I have yet to see much coverage focusing on battery technology as a key issue at the forefront of geopolitical power dynamics.

As the industry continues to grow all of these key technologies and issues become more and more interlinked (i.e. think full electric self driving car powered on NVIDIA GPUs), its often the neglected industry that becomes the main driver of influence and where key technology innovation differences can persist for longer.

This is a fascinating time to be involved in this industry and I plan to continue writing on the subject in the coming years.

Feel free to email me at javier [@] nomaddo.io or reach out to me via my Linkedin

Love it! Very comprehensive and in depth dive of the EV application, what are you thoughts on critical infrastructure and data center usage?

Check out NiZn (Nickel Zinc) chemistry! I think Aesir is really onto something big